Swiss Climate Scores: a new milestone of transparency in sustainable finance

Swiss Climate Scores: Carbon4 Finance supports Swiss financial actors in publishing reliable climate information on their financial investments.

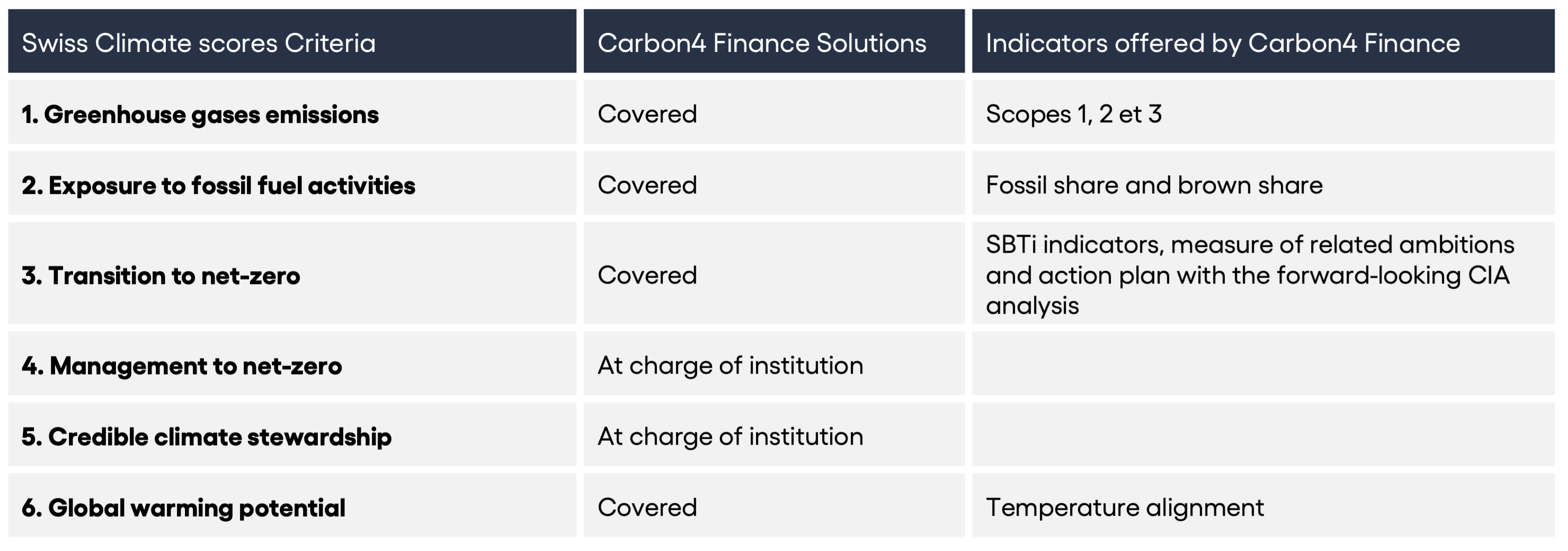

Good news for Swiss financial actors: with its historical climate database, Carbon4 Finance proposes an offer to meet the external indicators required by the Swiss Climate Scores, as shown in the table below.

Indeed, Switzerland wants to catch up with its neighbors' initiatives by establishing the Swiss Climate Scores.

Last June, the Federal Council launched the Swiss Climate Scores, establishing best practices in climate transparency to promote alignment with international objectives (Paris Agreements and Net Zero commitment by 2050).

Swiss financial market participants who want to contribute to the achievement of climate objectives will be able to voluntarily apply these Swiss Climate Scores to their portfolios and investment products. To do so, asset managers, banks and insurance companies will have to start reporting on the different indicators requested.

Criteria assessed[1] include greenhouse gas emissions, fossil fuel exposure, global warming potential, net zero strategy and commitments, and climate management.

According to the Swiss Federal Council, the Swiss Climate Scores go further than the European regulatory framework. Indeed, beyond the current performance of companies or portfolios, these scores provide forward-looking information on companies' strategy and action plans to achieve international climate objectives[2]. To guide investors in responding to the various indicators, a template has been developed by AMAS (Asset Management Association Switzerland) and SSF (Swiss Sustainable Finance)[3].

Drawing on its 15 years of climate expertise, the leading climate and biodiversity data provider Carbon4 Finance assists financial institutions in assessing and understanding the climate and biodiversity risks and environmental impacts of their asset portfolios. Among its clients, the European Central Bank, AtlantiComnium, Silex and Lombard Odier use the recognized expertise of the Carbone 4 group to measure their climate footprint.

The Carbon Impact Analytics methodology developed by Carbon4 Finance analyzes the climate transition risks of companies and sovereigns. This analysis results in a score for each company's contribution to the fight against climate change. Like the Swiss Climate Scores, the CIA rating goes beyond the current performance of a company's products and services by adding past and forward-looking indicators. We analyze the company's strategies, reduction targets and action plans to achieve its objectives to understand its decarbonization strategy.

Carbon4 Finance provides the necessary indicators to support Swiss financial institutions in the implementation of the Swiss Climate Scores. For more information, please contact us at contact@carbon4finance.com.