5-year anniversary of the publication of the European Commission’s Sustainable Finance Action Plan

This week marks the 5-year anniversary of the publication of the European Commission’s Sustainable Finance Action Plan

The adoption of the Paris Agreement in 2015 and countries' engagement to limit global warming to well below 2° sparked the need to rethink financial systems, and their role in the fight for mitigating and adapting to climate change. To do so, the European Commission appointed a High-Level Expert Group on sustainable finance which, in 2018, published a report on how to build a sustainable finance strategy in the EU. On March 8th 2018, the European Commission published its first Sustainable Finance Action Plan.

What are the goals of the EU Sustainable Finance Action Plan?

The goals are threefold:

- Reorient capital flows towards sustainable investment in order to achieve sustainable and inclusive growth

- Manage financial risks stemming from climate change, resource depletion, environmental degradation and social issues

- Foster transparency and long-termism in financial and economic activity

However, these goals clearly reinforce each other. For instance, transparency allows for a better reallocation of capital flows towards sustainable and less environmentally risky activities which, in turn, allows for a better management of financial risks.

In the last five years, what regulations were put in place in order to achieve these goals?

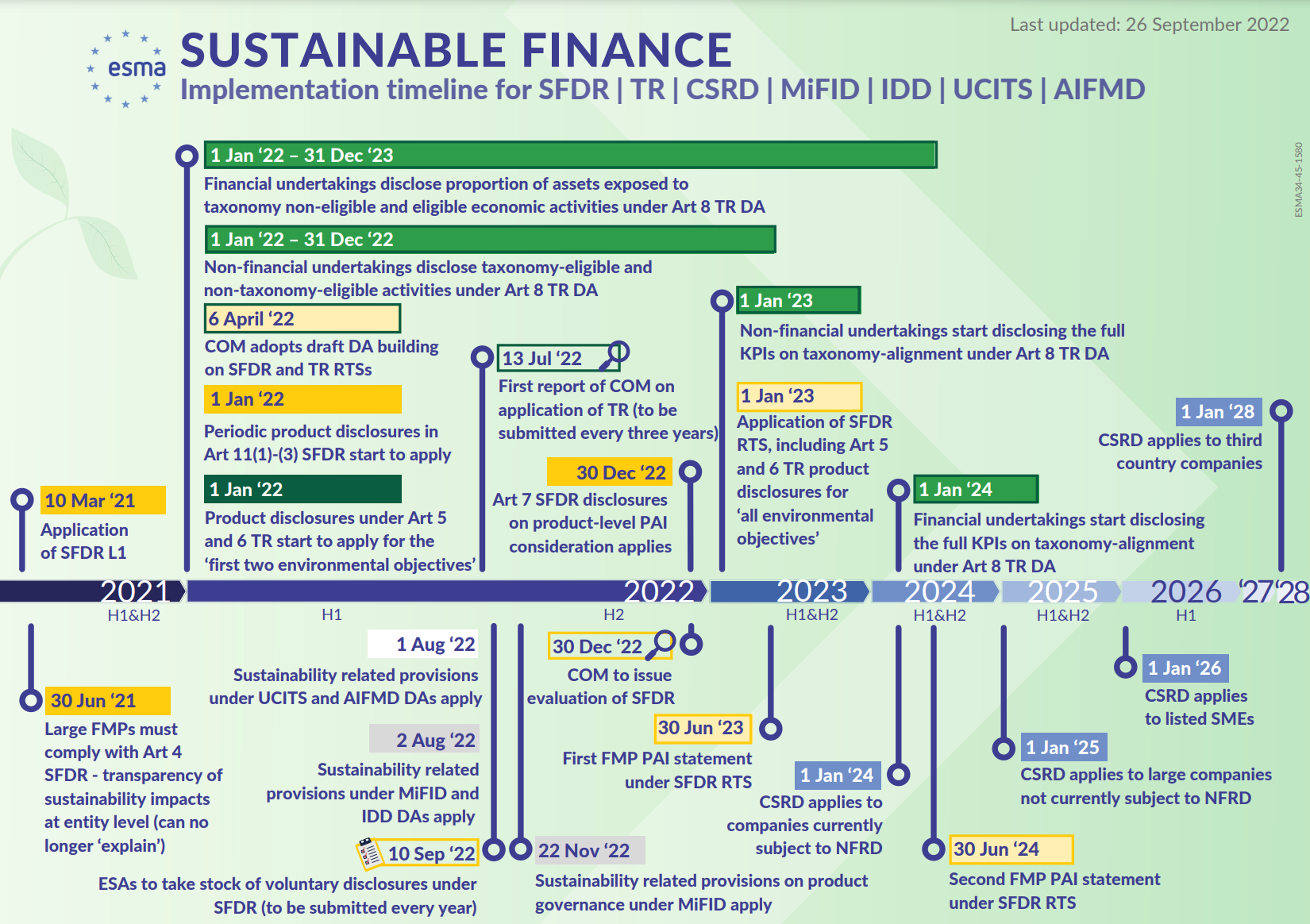

- The Sustainable Finance Disclosure Regulation (SFDR), to increase transparency around sustainability claims made by financial market participants. The SFDR offers a broader framework as it does not only focus on financial materiality (i.e the impact of climate related risks on organizations) but incorporates the concept of double materiality (looking also at the impact of organizations' activities on climate).

- A green taxonomy which defines, from an environmental standpoint, which activities are considered sustainable. The green taxonomy allows for a common language to be adopted within the EU, based on scientific research.

- The implementation and transition from the Non-Financial Reporting Directive(NFRD) to the Corporate Sustainability Reporting Directive (CSRD), which extends the transparency obligations of companies on the sustainability of their activities and their sustainability risks. In the following years, the CSRD will be extended to smaller European companies and then, to non-European companies dealing on markets under the European legislation.

- An amendment to the EU Benchmark Regulation which introduces two new benchmark classifications: the EU Climate Transition Benchmarks and the EU Paris-Aligned Benchmarks, and sets transparency requirements for ESG Benchmarks’ administrators.

- And, last week, a provisional agreement on the EUGBS, the European Union Green Bond Standard, a standard aligned with the taxonomy which will enable investors to orient their investments more confidently towards more sustainable technologies and businesses.

👉🏼 In just five years, the European governing bodies profoundly shaped the financial landscape in the EU. How can stakeholders rapidly adapt to these changes?

Leveraging 15 years of climate expertise developed by the Carbone 4 group, Carbon4 Finance aims to build bridges between banks, asset managers, asset owners and the companies they finance to turn the European Commission’s regulatory framework into action towards the decarbonation of our economies.

Our proprietary methodologies allow financial organizations to measure the carbon and biodiversity footprint of their portfolio, assess the alignment with a 2°C-compatible scenario and measure the impacts that arise from events related to climate change and biodiversity loss.