The oil sector: towards the last drop ?

Review of the oil & gas sector based on 2021 data

Summary

- The oil and gas industry has been the lifeblood of our economy for over a century. It irrigates all consumer sectors that are heavily dependent on hydrocarbons (agriculture, chemicals, transport, etc.).

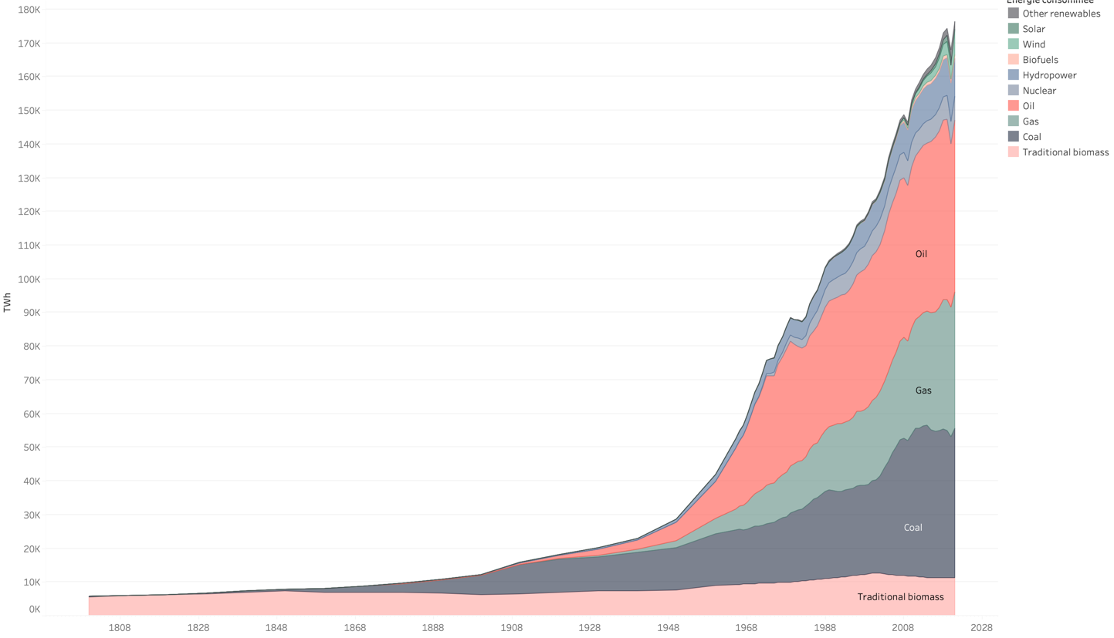

- Since the end of the 19th century, hydrocarbon production has grown steadily, as have emissions generated by their combustion. The climate crisis we are facing calls for a drastic reduction in hydrocarbon production by 2050, essential in meeting our climate commitments.

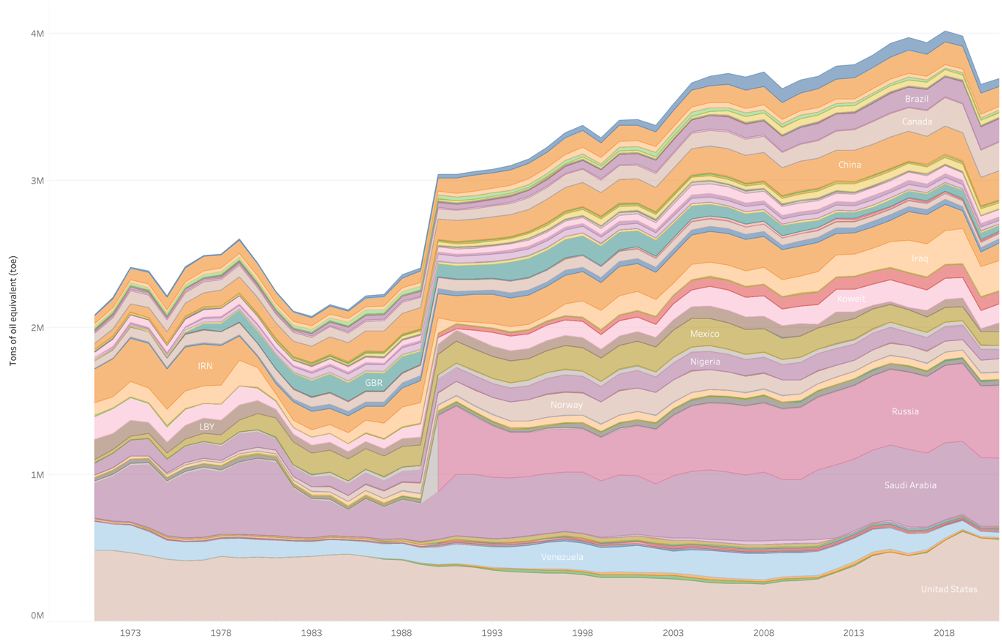

- Absolute emissions are rising steadily, and companies' targets for reducing these emissions (and therefore their hydrocarbon volumes) are still far too unambitious. In our sample, hydrocarbon production volumes (in barrels of oil equivalent) rose by an average of 31% between 2016 and 2021. The biggest increase comes from North America (+66%), boosted by the shale oil and gas boom.

- Transition risks are still largely inadequately considered, and most companies in the sector are, in fact, highly exposed to stranded asset risks, which are generally not publicly assessed. The sector's highly capital-intensive companies are driven by a short-term economic logic, which is exacerbated by current energy prices. As a result, they continue to invest massively in hydrocarbon exploration and production.

- Targets for reducing emissions linked to the combustion of products sold (scope 3) remain rare, even though such emissions account for around 80% of the sector's total footprint. Reducing scope 3 emissions implies a reduction in volumes extracted and sold, a lever that oil & gas companies still do not consider sufficiently. Scope 1 and 2 emissions reduction targets are more common, but too few companies are committed to reducing their emissions in absolute terms.

- Oil and gas discoveries are becoming increasingly rare, despite growing resources devoted to exploration and production: it's the Red Queen's paradox - you have to "run" faster and faster to stay put. Residual resources are increasingly difficult to access, and their exploitation is increasingly harmful to the environment (shale oil, ultra-deep waters, etc.).

- The oil and gas sector, boosted by its access to cheap credit, remains highly profitable, and does not seem ready to make the necessary shift. In this context, financial players, led by banks and asset managers, have a key role to play – that of directing financing towards companies which have begun their energy transition, while at the same time pursuing ambitious shareholder engagement policies. This is the aim of the CIA methodology, which distinguishes between companies that are ambitious in their strategy, and those that are less so.

Introduction

The modern oil era began in 1859, when Edwin Drake drilled the first commercial oil well. Oil had been discovered long before, but until then its use had remained marginal, and its exploitation small-scale. Oil would soon become "the blood of mankind". This expression, coined by Matthieu Auzanneau, author of the book "Or Noir” illustrates the vital role played by oil (and, by extension, gas) in our thermo-industrial, fossil fuel-driven society.

Today, global hydrocarbon consumption approaches 100 million barrels of oil equivalent per day, and oil accounts for 33% of the world's primary energy mix, compared with 24% for gas[1]. In terms of greenhouse gas (GHG) emissions, oil accounts for 27% of global emissions, and gas for 18%[2]. Oil consumption has been rising steadily for around a century, bringing with it a dazzling rise in greenhouse gas emissions. Today, this trend has resulted in an unprecedented concentration of CO2 and other greenhouse gases in the atmosphere, contributing to a very rapid rise in global temperatures.

Rising global temperatures threaten the equilibrium of human life on Earth and bring with them their share of climatic catastrophes. So much so that combating global warming and reducing greenhouse gas emissions has become humanity's most important challenge. Signed in 2015, the Paris Agreement aims to keep global temperature rises well below 2°C, or even 1.5°C by 2100, hence avoiding the worst consequences of climate change.

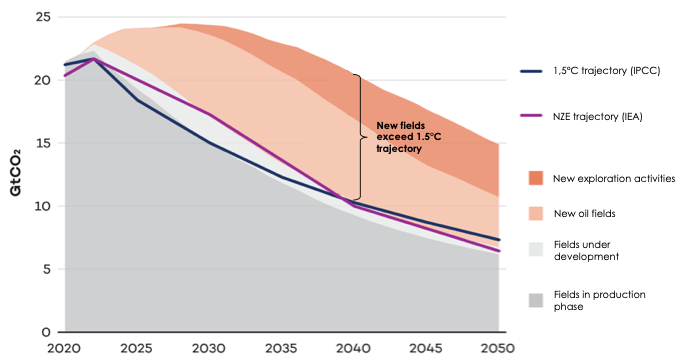

In concrete terms, meeting the 1.5°C target implies that human activities will have to become net-zero by 2050[3]. This objective calls for major paradigm shifts within our societies. As far as the oil and gas sector is concerned, according to the International Energy Agency (IEA), this should have resulted in a total halt of new oil and gas drilling by 2021[4]. However, numerous oil and gas projects are currently under development, all of which are incompatible with the 1.5°C warming trajectory, as shown in the graph below.

According to joint estimates by the IPCC (the Intergovernmental Panel on Climate Change) and the Global Carbon Project, the global carbon budget that must not be exceeded if we are to have a 66% probability of staying below the 1.5°C threshold is equivalent to 260 GtCO2e (billion tons of CO2 equivalent), from 2022 onwards[5]. At the current rate of emissions, this budget would be exhausted in six and a half years. However, oil and gas reserves known to date (the accuracy of these figures is open to debate) could emit 980 GtCO2 if exploited, i.e. two and a half times the carbon budget remaining to meet the Paris Agreement. It is therefore essential that a large proportion of these reserves remain in the ground: it is a condition for achieving our climate objectives. The graph below shows the IEA's Net Zero Emissions trajectory and that of the IPCC, both of which are compatible with 1.5°C warming. However, new oil fields and exploration (in orange and light orange) are largely incompatible with these trajectories.

Nevertheless, oil companies continue to invest heavily in the exploration and commissioning of new hydrocarbon deposits. This trend is largely driven by the massive development of unconventional hydrocarbons, particularly in North America. By 2030, the United States is expected to account for 60% of global growth in oil and gas production, driven largely by shale oil and gas[6]. According to estimates, the drilling of new oil and gas reserves in the USA - mainly shale - would induce emissions of the order of 120 GtCO2, or more than a quarter of the global carbon budget to be met if we are to have any chance of limiting global warming to 1.5°C by 2050[7]. Furthermore, this figure does not include emissions linked to methane leaks induced by the exploitation and transportation of hydrocarbons, which could increase emissions linked to the expansion of oil & gas activities in the United States by between 10% and 24%[8].

The commissioning of new operations buries the objectives of the Paris Agreement. Oil companies appear to be unaware of the risks associated with climate change and have no plans to reduce their oil and gas production in the short to medium term. What is more, the recent surge in the price of hydrocarbons has given them considerable financial resources, enabling them to develop less profitable operations, thereby locking humanity in a warming trajectory largely superior to 1.5°C[9].