The EU Green Bond Standard, a game changer in the low-carbon transition?

Introduction

The EU Green Bond Standard is a concrete application of the EU taxonomy, but a quantitative assessment of the climate impact remains out of investors’ reach. Carbon4 Finance equips investors with a dedicated measurement tool.

The market for green bonds (GB) has steadily developed over the last few years. In 2020 alone, green bonds’ issuance topped close to USD 300 billion (CBI, 2021[1]). However, its issuance barely represents 4% of the total corporate bond issuance in 2020[2], while the European Commission expects green bonds to become one of the largest sources of green investment as to meet the green investment gap in Europe. Until now, the GB landscape was based on market-defined standards, with a possible lack in transparency, consistency, and credibility for investors. Without a proper bottom-up analysis of climate mitigation contribution, greenwashing hinders the transition to a low-carbon economy. But with the European standard for green bonds, this is about to change.

Carbon4 Finance has for years supported investors with assessing the climate impact of 900+ Green Bonds, evaluating their contribution to climate change mitigation. This new regulatory development lays the foundation for a standardized and more transparent process for green bonds issuance, a much-awaited development.

EU GBS, the new “Gold standard”

Green bonds will play a critical role in the decarbonization of all sectors of our economy. However, the definition of “green” activities remains fuzzy, relying on market-defined standards (e.g., Green Bond Principles, Climate Bond Initiative), less comprehensive and ambitious than the European Taxonomy. In July 2021, the renewed European Sustainable Finance strategy introduced a long-awaited green bond framework, called the “EU GBS” – or European Green Bond Standard.

With the European Green Deal[3] and its ambition to reduce EU’s emissions by 55% its emissions by 2030 (compared to 1990 levels)[4], substantial investments are needed in all sectors to reach Europe’s climate commitments. For Ursula Von Der Leyen, the President of the Commission, this framework will “set a “gold standard” for how investors can recognize bonds representing real green investments, to help them make the right choice.”[5]

Following the Technical Expert Group’s recommendations[6], the EU GBS addresses the inherent greenwashing and transparency challenges. It will be a voluntary standard, open to any EU and non-EU issuer. Only green projects (green assets and expenditures – OPEX and CAPEX), which are 100% aligned with the EU Taxonomy requirements would be eligible for obtaining the standard (for more background on the taxonomy, read this insightful analysis by Carbone 4[7]). It is therefore a strong and structuring element towards a standardization of the green bonds market.

This “Gold standard” is broken down into four crucial requirements:

- Projects should be aligned with the EU taxonomy, contributing to one of the six environmental objectives, complying with the DNSH[8] principle and the Minimum Social Safeguards, and satisfying the Technical Screening Criteria as defined in the taxonomy (for more clarity on environmentally sustainable activities on the two first criteria, see the insightful Taxonomy Compass[9]).

- Full transparency required with detailed reporting on the use of proceeds: Issuers will need to fill in an EU GB factsheet, annual allocation reports, a post-issuance review report, an impact report with explanations on environmental impacts, and a prospectus which explicitly states the underlying objectives.

- External reviewers will check that each EU green Bond comply with the standard’s requirements.

- A standardized supervision of external reviewers by the ESMA –European Securities and Market Authorities– will ensure the accreditation of companies and individuals acting as examiners.

These requirements are a major step forward for improving transparency in the green financing market. This high-quality Green Bond standard will provide investors with the assurance to contribute to the low-carbon transition. However, with the daunting process and significant costs associated with issuing an EU GBS, issuers could believe that the advantages of reaching new investors might not outweigh the related costs.

Additional quantitative measurement is key as to understand the impact of Green Bonds for investors

Carbon4 Finance is a recognized carbon data expert, providing an independent climate impact assessment of green bonds and their contribution to a low-carbon economy. For investors, our green bonds solution is a way to ensure a bottom-up analysis of a bond’s climate impact is conducted.

Through our green bonds offer, we quantify the climate impact of green bonds. We provide induced emissions on Scopes 1&2 but also Scope 3 emissions, which are crucial in tackling the climate crisis (as underlined in our recent article[10]).

In addition to understanding that a particular bond is really green, the Carbon4 Finance’s green bonds methodology provides a concrete quantitative measurement of the degree of contribution, via the avoided emissions. For example, it can be emissions avoided thanks to the use of an entity’s products compared to other products available on the market (e.g., EVs compared to thermal engines, or biofuel compared to conventional fossil fuels). A company avoids emissions if there is a gap between the induced emissions of the company and the reference situation, as illustrated in the figure below

Building on the two previous indicators, the Carbon Impact Ratio (CIR) provides information on the carbon impact of a company or portfolio to the energy transition. The CIR is the ratio of emissions savings (avoided emissions) to induced emissions. This indicator represents the capacity of a project to reduce GHG emissions compared to emissions induced by its activity.

Our proprietary methodology is based on project analysis: we review each project financed by a green bond, then results are consolidated at the bond level. We focus on renewable energy projects (both generation and T&D), energy efficiency projects in real estate, and low-carbon transport infrastructures (rail, bus and bike) and offerings (EVs). A transparency score provides information on the level of detail in green Bond reporting documents.

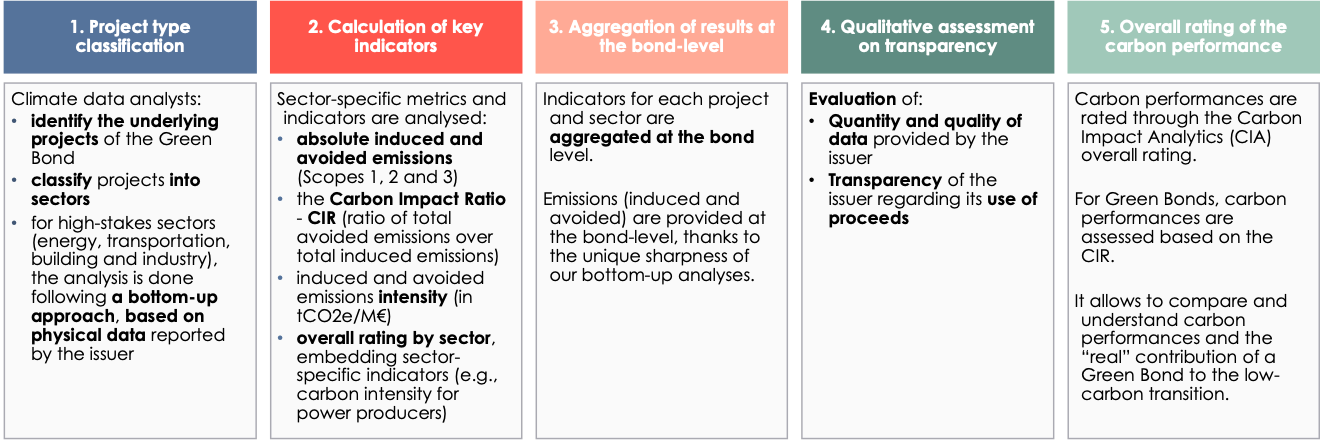

Carbon4 Finance green bonds methodology is a five-steps analyst-driven climate assessment

If you would like to know more about our Green Bonds database, please contact our team at contact@carbon4finance.com.

In practice: Climate Awareness Bonds launched by the European Investment Bank

This Green Bond (GB), issued in October 2019, is part of the EIB GB program launched in 2007. Bonds are named Climate Awareness Bonds (CAB). Proceeds of this bond finance projects related to renewables energy, T&D, Sustainable transportation, Building construction & Energy efficiency.

On October 22nd, Carbon4 Finance organized a webinar on the matter.